Learn how Rutter can help you accelerate your product roadmap, save engineering headaches, and grow revenue

Our team at Rutter is proud to introduce our latest product launch, the Bank Feeds API, which allows companies with business banking, corporate cards, accounting automation, and payment products to import bank and credit card transactions to accounting systems without requiring manual uploads.

Use our Bank Feeds API to easily integrate bank feeds into your app. It automatically sets up the infrastructure and streamlines the process of uploading bank statements to the accounting platforms your customers use.

Today, we are releasing Bank Feed support for NetSuite and Sage, with support for Quickbooks, Xero and more on the way.

See our Bank Feeds API for more implementation details. View documentation

Watch our Bank Feeds demos for NetSuite and Sage.

Bank Feeds: Enable seamless accounting reconciliation

In business finance, bank transactions act as the definitive record of all business activities, and finance teams must ensure these transactions are perfectly reflected in the accounting systems. This is where the power of bank reconciliation comes into play.

What is Bank Reconciliation?

Bank reconciliation is like a financial health check for your business. It's the process of ensuring that your recorded accounting transactions match the money movements in your business’ bank accounts. This is essential for maintaining precise and trustworthy financial records.

The Role of Bank Feeds

Enter the Bank Feed - a must-have tool that bridges your customers’ bank accounts with their accounting software. With a Bank Feed, all transaction data automatically flows into the end-user's accounting system, enabling seamless reconciliation. This saves time and drastically reduces the chances of human error.

The Challenge of Manual Data Uploads

Without the ability to programmatically upload bank transactions, B2B fintechs require finance teams to upload bank transaction data in a PDF or CSV manually. Supporting automated Bank Feeds in your expense management or business banking product is quickly becoming a must-have for end users.

Our Solution: Accounting Integration and Bank Feeds

We previously launched our Accounting API, which allowed finance teams to sync expenses and bill pay data directly to their accounting systems. However, to provide a comprehensive solution, finance teams need two key integrations:

- Accounting Integration: This syncs expenses from corporate cards or bill pay products directly with the accounting system.

- Bank Feeds: These ensure that all bank transactions related to those expenses or bills are also captured and recorded within the same system.

By combining both accounting integration and bank feeds, we empower finance teams with complete and accurate data, facilitating faster and more precise reconciliation.

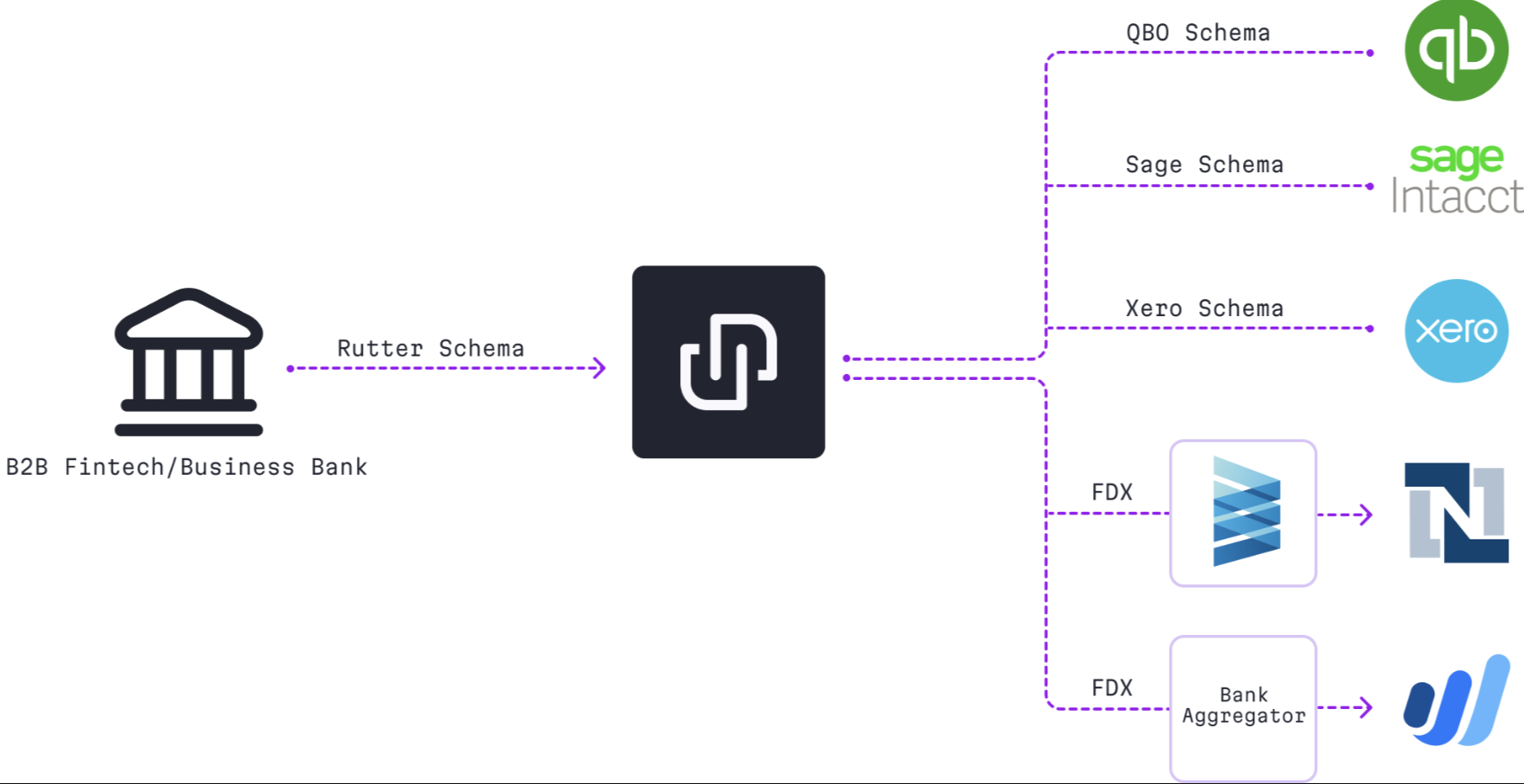

Rutter’s Unified API approach to providing bank feeds

Integrating Bank Feeds into your accounting system can be achieved in two main ways:

1. Direct API Integration The first method involves a direct connection through the accounting system's API. This approach allows for a direct and streamlined sync of bank feeds, ensuring that your financial transaction data is automatically and accurately reflected in your accounting system.

2. Banking Data Aggregators The second method utilizes banking data aggregators like Plaid, Yodlee, and MX. These platforms serve as intermediaries that connect your bank accounts with your accounting system. They are beneficial when direct API integration is unavailable, providing a versatile and comprehensive solution for bank connectivity.

Rutter’s Unified API offers the benefits of both approaches, offering an efficient, scalable, and flexible option and can be especially valuable for companies looking to offer and manage multiple bank feeds while offering a robust integration product experience for their customers.

- Simplified Development: Implement a single API to enable bank feeds within multiple accounting systems — even when underlying bank APIs are different

- Broader Coverage with Enhanced Flexibility: Adapts to various systems and requirements, making it versatile for different applications.

- Lower Cost and Centralized Maintenance: Offers centralized maintenance and updates, reducing the burden on internal engineering teams.

Try Rutter Bank Feeds

If you’re a business bank or corporate card provider that’s looking to seamlessly integrate banking or card data into your customers’ accounting systems, we invite you to book a demo with us or sign up to get started.

.png)

.png)

.jpeg)