How Notch Launched 5 New Integrations In Weeks

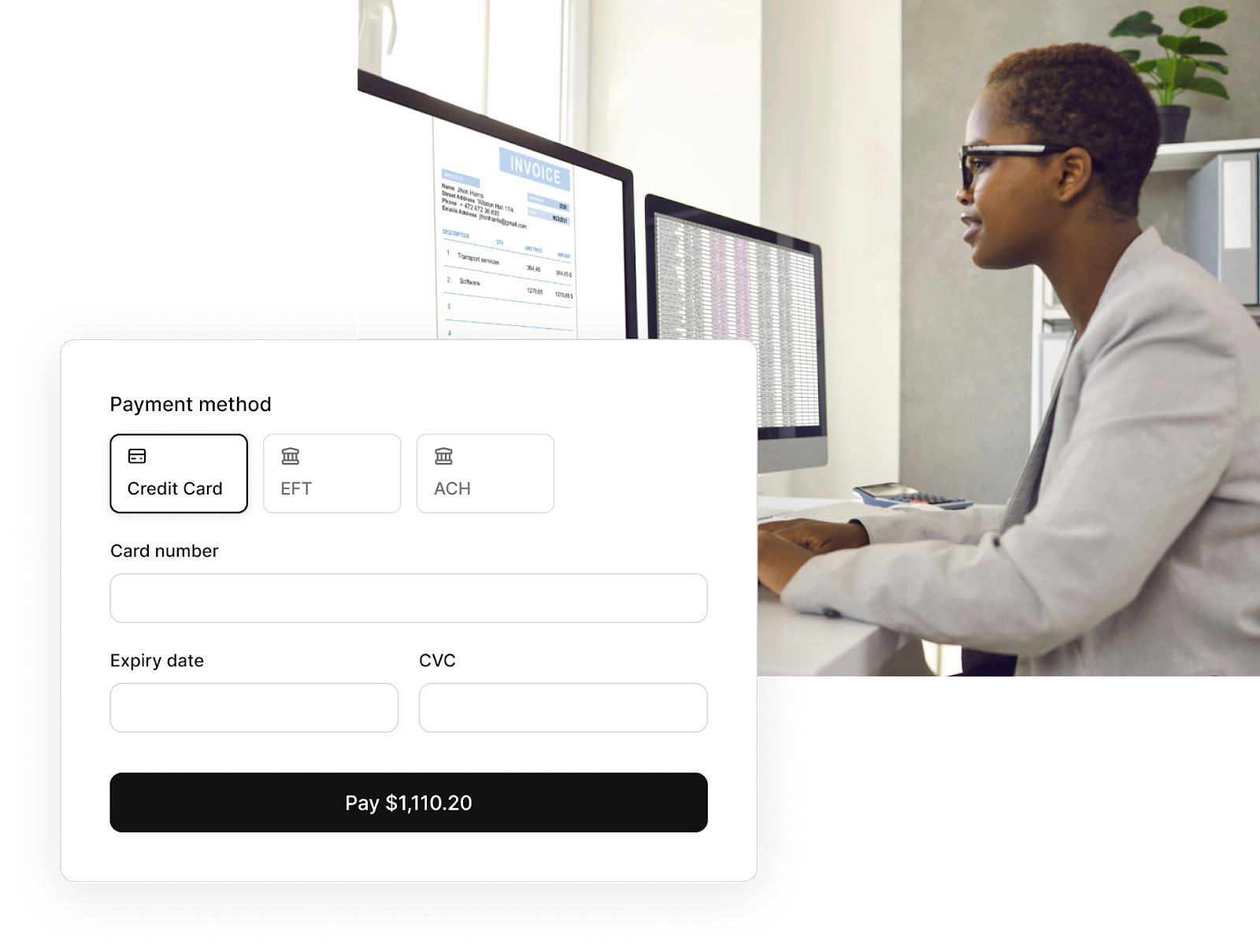

Notch Financial, a leader in accounts receivable and accounts payable automation for the food and beverage industry, set out to simplify invoice payments and lower operational expenses for their customers.

Trusted by leading B2B fintech companies

Learn how Rutter can help you accelerate your product roadmap, save engineering headaches, and grow revenue

Notch Financial, a leader in accounts receivable and accounts payable automation for the food and beverage industry, set out to simplify invoice payments and lower operational expenses for their customers. They hoped to leverage AI technology to streamline invoice processing and seamlessly integrate it with many accounting and inventory management platforms their customers are using. Leveraging Rutter’s Unified API, Notch Financial was able to save time and money for restaurant owners in managing their invoices and bills.

Notch

Building integration with QuickBooks alone required more effort and iterations than expected

Prior to building out their product, the Notch team spent a significant amount of time chatting with restaurants and potential customers to understand their day to day workflow and needs.

One of the primary issues was the prevalence of manual processes among their customers. Many clients relied on manual, error-prone procedures, such as handwritten invoices and manual check writing. This led to time-consuming and inefficient payment processes.

Another significant challenge was the time-consuming process of inputting financial data into their accounting platforms. In order to automate this manual process, the Notch team would need to build out integration with accounting systems to automatically sync and reconcile bill and invoice data into their customers’ accounting platform. The initial phase involved identifying the pressing need for integrations, particularly within the restaurant and hospitality sectors. QuickBooks Online (QBO) emerged as a widely used accounting platform among Notch Financial's customer base.

To address this need, Notch Financial started to mobilize internal engineering resources to build out native integrations. They initially estimated this effort to take 2 full-time engineers a couple of months to build. However, it turned out to be a lot longer and more time-consuming than initially estimated. The process included continuous iterations and enhancements spanning nearly a year to ensure a seamless and robust integration with QBO.

As Notch Financial engaged in discussions with customers, they recognized a diverse array of integration requirements beyond QBO. These included platforms like Xero, NetSuite, Dynamics 365, Sage 200/300, Sage Intacct, and QuickBooks Desktop (QBD).

In addition, Notch Financial recognized the need to expand its integration offerings to serve a broader customer base effectively. This expansion required collaboration with external teams to meet the growing demand for integration solutions. Hence this prompted them to start looking for external vendors to help support their integration roadmap.

Selecting vendors with most robust API coverage and relevant platform coverage

In evaluating vendors, Notch looked for a vendor who can meet their platform and API needs. They ultimately chose Rutter due to its depth of integrations and API functionalities, including re-syncing functionalities - the ability to sync and re-sync bills and invoices.

Why syncing and re-syncing matters: Notch’s customers require the ability to update their bills and they want this process to be as automated as possible to save time. At Notch this means automatically keeping bills in sync across Notch, accounting and IMS integrations via 2-way matching. The syncing also has the benefit of ensuring data accuracy.

How this works: If a bill is modified in a customer's accounting, then Rutter sends the changes to Notch (via webhook) and the bill gets updated. If a bill is modified in Notch, then those changes get re-synced to the accounting integration through Rutter. This means Notch’s customers bill data is always kept in-sync and stays accurate across applications.

In addition to evaluating existing technical depth and product capabilities, the Notch team realized that no vendor will provide exactly 100% of what they need. They needed a responsive, adaptable integration partner who is willing to collaborate closely and promptly address feature gaps. The partnership enabled them to execute essential features in a timely manner.

.png)

.png)

.png)

Launching AR Automation Workflows with Rutter

Notch Financial's partnership with Rutter API has been instrumental in streamlining operations, enhancing integration capabilities, and achieving exceptional efficiency.

Notch intends to build an all-in-one invoice and payment platform for restaurants. They have plans to introduce additional integrations, including QuickBooks Desktop (QBD), and further enhance their offerings for AP and AR capabilities. Their vision includes creating a unified platform that serves suppliers, restaurants, and invoice management, positioning them for continued success and innovation.

Ship robust integrations fast

Add, read, and write integrations to many accounting, commerce, and payment platforms with a Unified API.

.png)

.png)