Learn how Rutter can help you accelerate your product roadmap, save engineering headaches, and grow revenue

We’re excited to announce that we’re officially working with Mercury to help provide banking* products that empower founders to build great startups. Mercury offers checking and savings accounts with no monthly fees, physical and virtual debit cards for entire teams, free domestic and USD international wires, and earlier this year, launched its own Venture Debt program to help companies extend their runway without sacrificing equity.

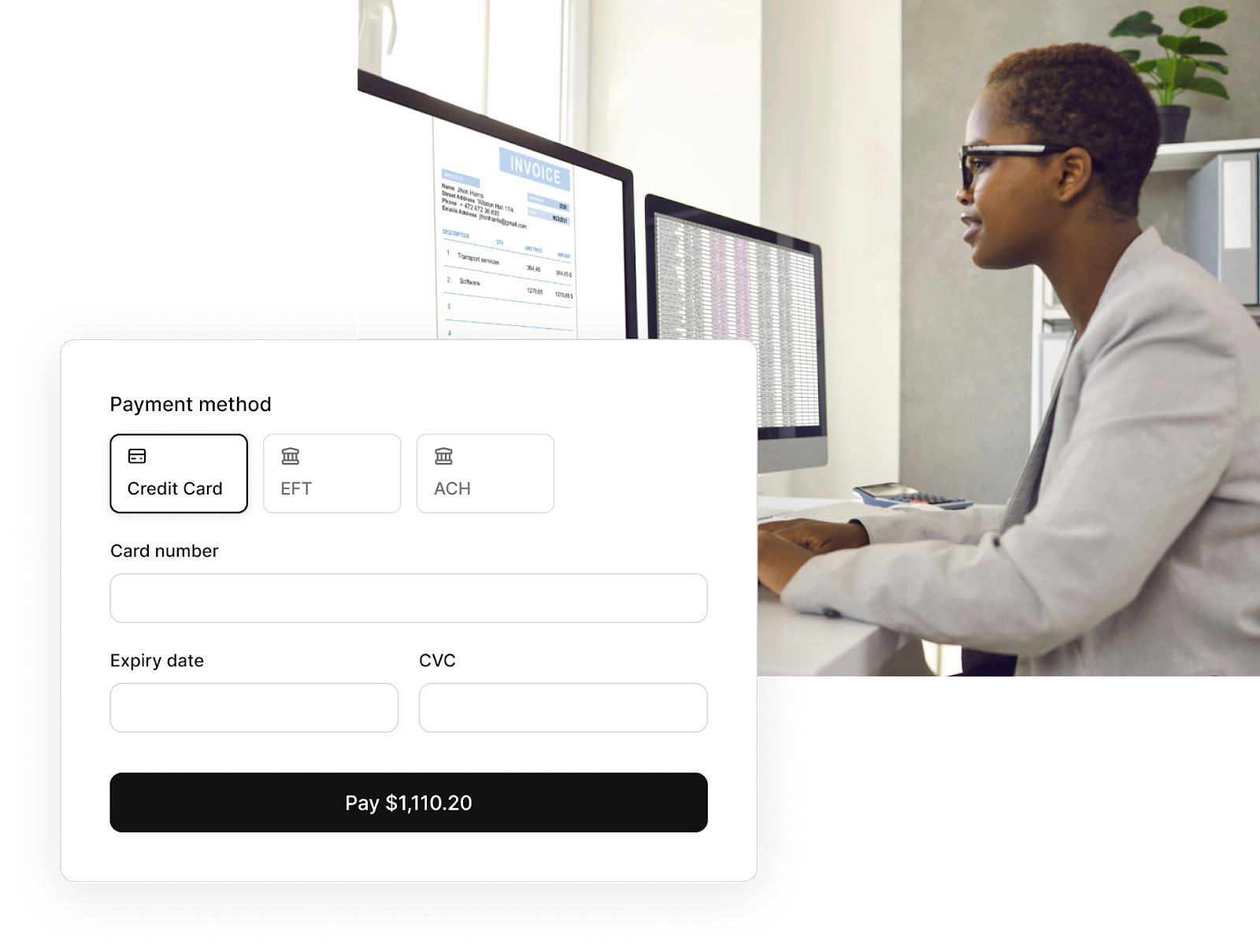

Mercury will be using our Accounting API to streamline the application process for their Venture Debt product as well as for portfolio management, ensuring a best-in-class user and underwriter experience.

Now when candidates apply for Mercury Venture Debt, they can link their existing accounting platforms like Quickbooks, Xero, Netsuite or Sage, enabling Mercury to fetch all the necessary data for the underwriting process. This link is preserved when an applicant becomes a Venture Debt customer, resulting in seamless ongoing reporting and eliminating any unnecessary back and forth with capital advisors.

After undergoing an extensive evaluation period over the last few months, the Mercury team ultimately picked Rutter as the preferred vendor due to our focus on developer experience, accounting platform coverage, and white-glove customer success program.

Mercury’s Business Lead for its Capital division, Parker Wilf, notes, "We're eager to revolutionize the Mercury Venture Debt application process with Rutter. We believe that digitizing the diligence process is an industry-first that will make applying for venture debt much quicker and more seamless for our customers."

Rutter is proud to work with one of the fastest-growing companies in the fintech space – this is a huge milestone for us. Additionally, Mercury will be one of our flagship customers using our Accounting API product, for which we recently announced majority platform integration coverage for US and UK accounting platforms.

Rutter CEO Peter Zhou shared, “We’re excited to be working with the team at Mercury. The last few months were a great start to our partnership and we look forward to helping one of the leading fintech companies build their financial data infrastructure.”

*Mercury is a financial technology company, not a bank. Banking services provided by Choice Financial Group and Evolve Bank & Trust®; Members FDIC.

Interested in learning more about Mercury? Watch our panel discussion on the future of alternative financing for business lending featuring product leaders from Mercury, Stripe Capital and Rutter. Panelists discussed innovations within the lending stack, trends companies are exploring in alternative financing, new types of financing instruments, how companies should evaluate different financing options, the role data plays, where value is captured in the financing industry and more.

.jpeg)