Learn how Rutter can help you accelerate your product roadmap, save engineering headaches, and grow revenue

Accounting software is one of the most important pieces of software every business needs to manage their entire business and to improve financial management.

According to a research done by Skyquest consulting group, Global accounting software market was valued at USD 13.7 billion in 2021, and it is expected to reach a value of USD 47.5 billion by 2028, at a CAGR of more than 19.4% over the forecast period (2022–2028).

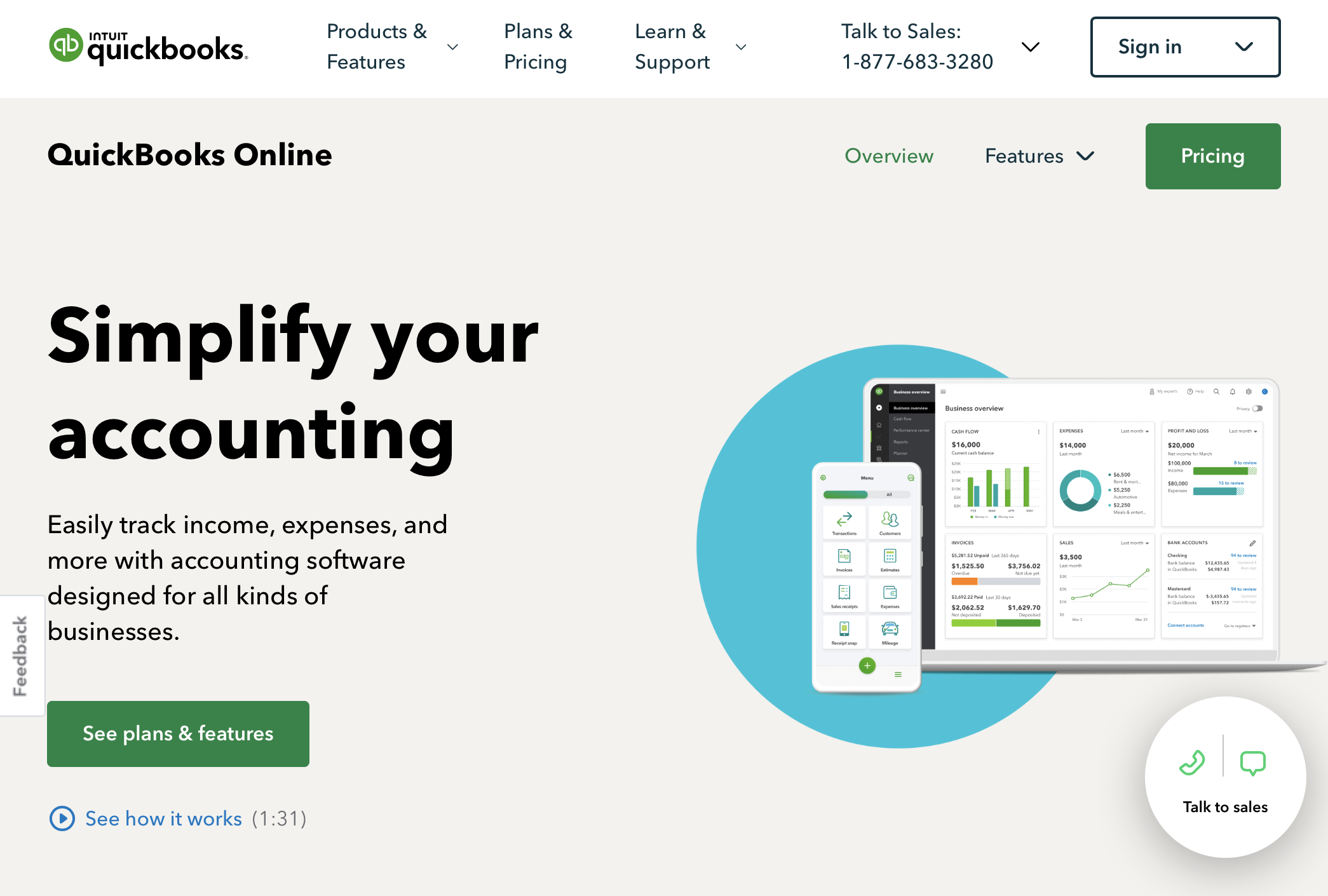

Today we dig into one of the most popular accounting software companies out there Quickbooks.

Quickbooks Overview

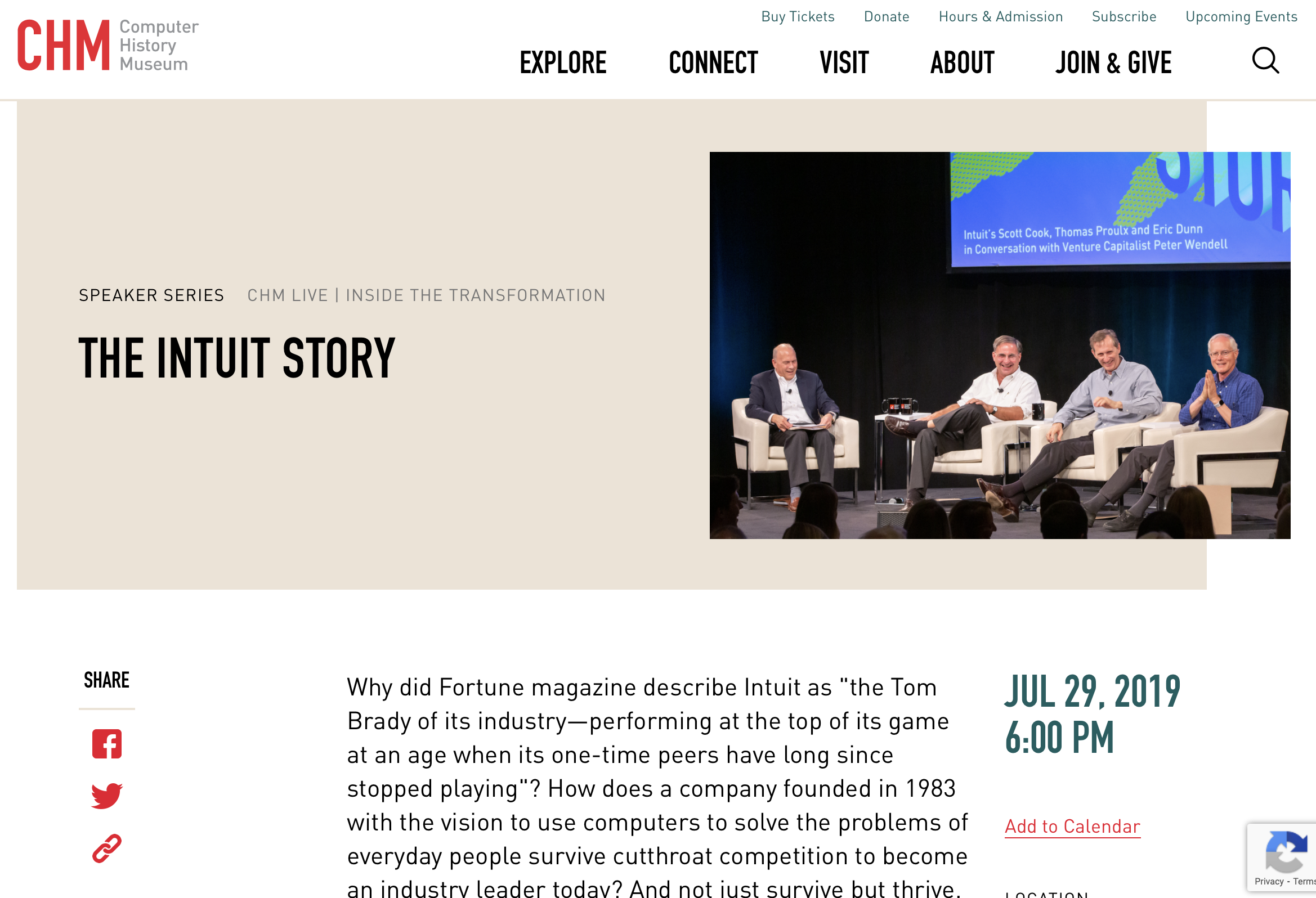

QuickBooks is the most popular accounting software programs in the global accounting software market. Quickbooks was started by Intuit which was founded back in 1983 by Scott Cook and Tom Proulx in Mountain View, CA just two years after IBM introduced their first personal computer.

Quickbooks was inspired by Quicken, a personal accounting package. QuickBooks was intended to offer small business owners the flexibility of an easy-to-use software package and the structure and compliance that are needed to manage a profitable business.

The small business segment for Intuit grew its revenues 41% year over year to $1.77 billion, driven by the solid growth in customers for QuickBooks Online. QuickBooks has a market share of over 60%+ in the global accounting software market and over 80% in the US. Of all the customers that use Quickbooks, a majority are small businesses.

Quickbooks Online is most known for their Quickbooks Online Accounting software. QuickBooks Online Accounting revenues were up 34% year over year to $623 million.

The Online Ecosystem comprises revenue from:

- QuickBooks Online, QuickBooks Online Advanced, QuickBooks Live, and QuickBooks Self-Employed financial and business management services.

- Small business payroll services- QuickBooks Online Payroll, Intuit Full-Service Payroll, Intuit Online Payroll.

- Merchant payment processing services for small firms that use online services.

- QuickBooks Cash, QuickBooks Commerce, and financing for small firms.

The revenue generated from the online ecosystem is 59% of the total revenue generated by the company. It increased from $621 million in Q1 2021 to $845 million in Q1 2022, marking a 36% growth on a year-on-year basis which is incredible growth for an incumbent giant in the space.

What is Accounting Software?

An accounting system helps companies focuses on bookkeeping activities and helps a company manage their expenses, invoices, bills, inventory, accounts payable, accounts receivable and more. Accounting software also helps companies put together financial statements, such as profit and loss reports and balance sheets which are important for every business to understand and to help them report to stakeholders.

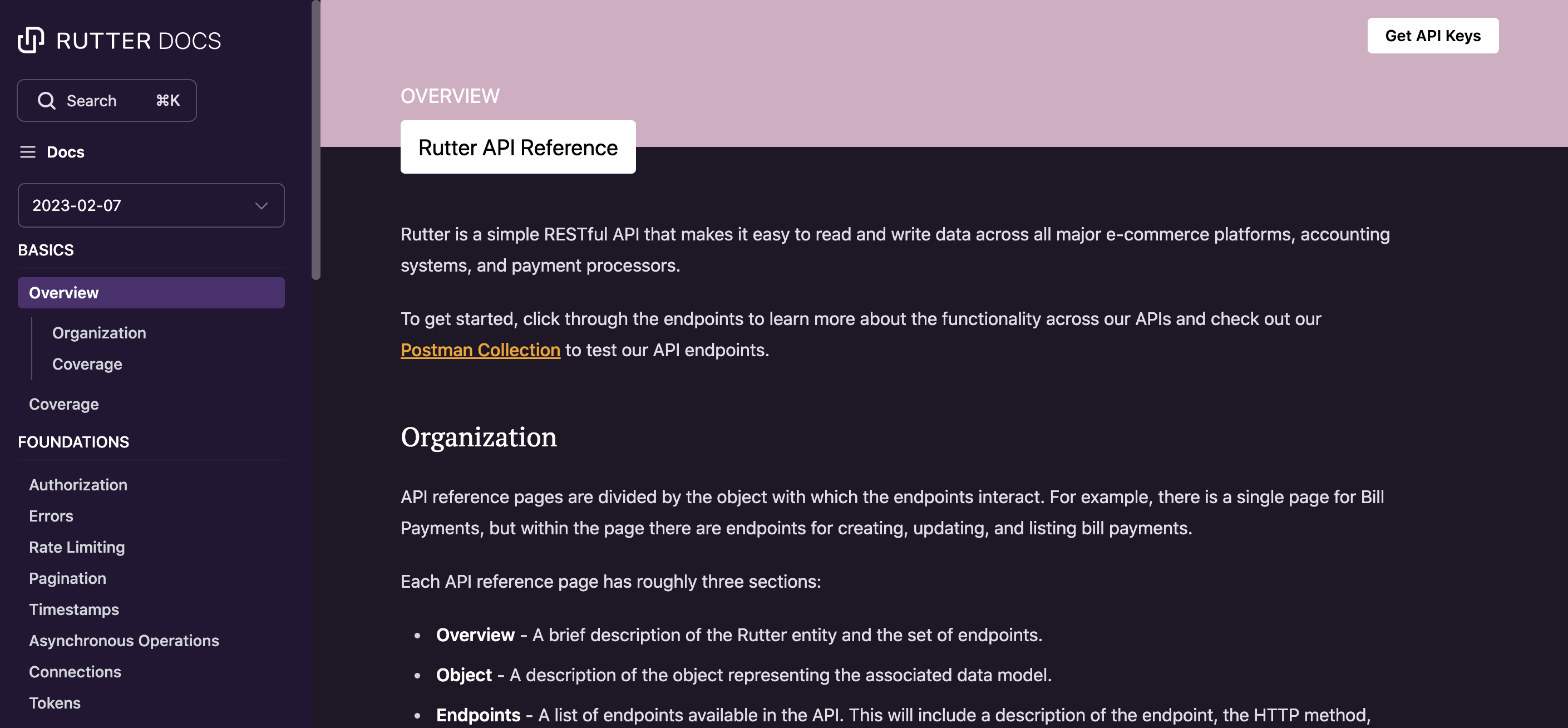

Rutter helps companies build integrations to various accounting systems including Quickbooks, Xero, Netsuite, Sage Intacct, Microsoft Dynamics, Zoho, Wave, Freshbooks and more.

Quickbooks Desktop vs Quickbooks Online

A lot of people have questions around the differences between Quickbooks Desktop and Quickbooks Online.

QuickBooks Desktop is a more traditional accounting software that you download and install on your computer, while QuickBooks Online is cloud-based accounting software you access through the internet. For the Desktop version, you pay an annual fee starting at $349.99 per year, and the cloud-based option starts at $15 per month.

Quickbooks Desktop is being phased out by Intuit slowly and encouraging users to import their files and move to Quickbooks online. Starting in May 31, 2023, access to QuickBooks Desktop Payroll Services, Live Support, Online Backup, Online Banking, and other services through QuickBooks Desktop 2020 software will be discontinued by Intuit. As we can see in the table below, Quickbooks Online Ecosystem has outpaced the Desktop ecosystem which has led to Intuit investing more and more in the online version.

Quickbooks Online Accounting

Quickbooks has the reputation for being the go to accounting software for any small business looking to get started quickly. Quickbooks very base plan is at $15/month being a very affordable option for any small business. Quickbooks online accounting has a wide set of features from providing you with the base accounting tools to add-ons that give you the ability to manage inventory, bills, expenses and more through the same software.

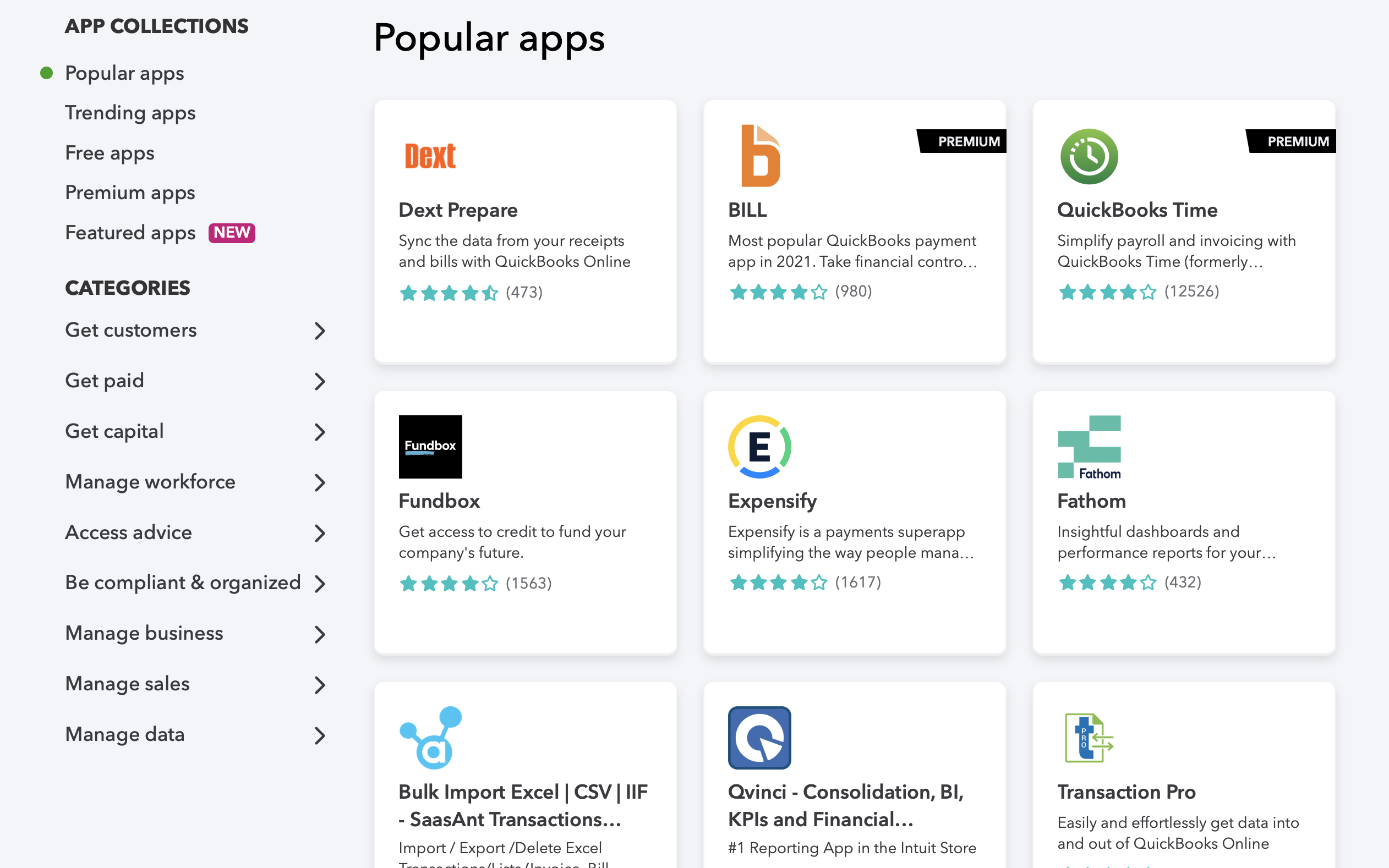

Quickbooks Online Ecosystem

The Quickbooks online ecosystem includes hundreds of applications that integrate nicely with Quickbooks. Some of the most popular ones that Quickbooks offers as well include: Quickbooks Payroll, Quickbooks Payments, TSheets by Quickbooks, Quickbooks Capital and 650+ third party applications for billing, analytics, CRM and more.

The Quickbooks app ecosystem is a growing one with thousands of developers building for small businesses. One of the most popular applications in the Quickbooks ecosystem include lenders. Intuit has now facilitated over $1B of financing for QuickBooks customers through partners and its own lending facility. App developers and startups are able to tap into the Quickbooks ecosystem easily which is what makes the open API so attractive.

Why do businesses need accounting software?

Most small business owners might start out by managing their books using pen and paper or Excel. Accounting software is useful because it helps business owners save significant amount of time and effort on tasks that can be automated when it comes to managing a businesses’s finances.

In addition to saving time, accounting software also helps improve accuracy since there’s always the possibility of human error when someone manually enters financial information into excel. Accounting software like Quickbooks typically have features like receipt capture and bank reconciliation that makes it easier for business owners to avoid errors.

Finally, accounting software can also generate advance reports for businesses like a balance sheet, a cash flow statement and an income statement out of the box. These reports help business owners better understand the health of their business.

Case studies on the QuickBooks website how small businesses save hours on payroll, reduce frustrations with record-keeping, and feel more comfortable with handling finances.

Brief History of Quickbooks

Intuit cofounder Scott Cook watched his wife struggle to balance the family checkbook when he realized there must be a better way. The first Intuit product he created was called Quicken and it changed the world of personal finance. Scott and his cofounder Tom Proulx bootstrapped the company for several years before raising their first round of funding from Kleiner Perkins in 1990.

Quickbooks was first introduced in the 1980s as one of Intuit’s early products shortly after the runaway success of Quicken. Scott shares in an interview on CNN, “Well, we built this [Quicken] as a consumer [home use] product. When we surveyed our customers, half of them--48%--claimed to be a business. I ignored it; I thought, That must be a mistake. Then we did the same research a year and a half later: 49%. I ignored that. It was only later that we got it.

He added, “We had thought, Why aren't they buying accounting software? In a nutshell, the answer was the vast majority of small businesses don't have an accountant on staff. They don't know a debit from a credit; they think "general ledger" was a World War II hero. Yet nobody made a product for them. Again, it's the power of paradigm. It makes you twist and misinterpret it to see what you want to see. The best business book I've ever seen is [Peter F.] Drucker's Innovation and Entrepreneurship. He ranks the great sources of business ideas, and the No. 1 breakthrough is surprises. But you have to be able to see them.”

Intuit went public in March 12, 1993. In 2003, Quickbooks released industry specific version that created reports and workflows that were tailored towards specific industries. Quickbooks also started to build an ecossytem of accountants and CPAs aeound them thorugh the Quicbooks ProAdvisor Program.

In 2013, Intuit announced that it had rebuilt QuickBooks Online "from the ground up" with a platform that allows third parties to create small business applications and gives customers the ability to customize the online version of QuickBooks. In end of 2020, Intuit rolled out QuickBooks 2021 with several improvements in payments and automation. All the desktop editions in this version got advanced features like streamlined bank feeds, automated receipt management, rule-based customer groups, payment reminders, customized payment receipts, data level permissions, and batch delete sales orders.

In 2022, Intuit launched QuickBooks Online Advanced. New features include better analytics, automatic backups, custom roles based on an employee’s job and more automation that allows users to set reminders for transactions with a due date, like invoices, payments, and more through various approval workflows. These new features are an effort by Intuit to bring Quickbooks Online up to speed with the powerful capabilities of the Desktop version.

Quickbooks API

Intuit has a very comprehensive and easy to get started developer portal which has led to the explosive growth of their app ecosystem. The Quickbooks API really shines especially when compared to the APIs and app ecosystems of other players like Netsuite, Sage, Xero, etc. which require more customizability and have a lot more restrictions.

If you’re interested in building an application across Quickbooks and other platforms, learn more about Rutter’s Universal Accounting API which normalizes the schema across these APIs and makes it easier for developers to build applications for any accounting platform.

Sources and additional reading on Quickbooks:

https://www.forbes.com/advisor/business/software/quickbooks-online-vs-desktop/

https://www.theofficesquad.com/blog/how-quickbooks-stacks-up-to-its-competitors

https://businessquant.com/intuit-revenue-by-platform

https://www.softwarepundit.com/accounting/do-i-need-accounting-software

https://www.kleinerperkins.com/case-study/intuit/

https://enlyft.com/tech/products/quickbooks

https://hbr.org/2015/01/intuits-ceo-on-building-a-design-driven-company

https://www.netsuite.com/portal/resource/articles/accounting/erp-vs-accounting-software.shtml

.png)

.jpeg)